The idea of the Third Reich was something that we became expressly familiar with through the second quarter of the last century. The German Empire was established by a power hungry megalomaniac hell bent of World Domination and German Totalitarianism. A single nation, under the leadership of one party, for the good of one race of people, come hell or high water. The effect of this madness? A war that wiped out millions of people, flattened whole cities throughout Europe and damaged the economies and geopolitical landscape of the Euro Zone for decades to come.

Fast forward sixty years, and the current German Chancellor seems to have pulled off what the Nazi Dictator Adolf Hitler yearned to do without the shot of a single bullet, without the concentration camps, massive armies and widespread destruction of infrastructure, assets and the establishment. How? Simple, forget about using the dominance of force, and allow the folly of man’s greed play the power into your hands.

Europe 2013 is meant to be a United Zone of nations, brought together in a common interest, to give equality, diversity and collective prosperity to every member country right? Governed by a parliament, protected by a system of complex legal legislative directives, and operated for the preferential treatment of members through a variety of agreements and allowances that enable growth and development through trade, financial stability and equality.

In its simplest terms, the Euro Zone is an agreement which sort to unify Europe. In a world unbalanced by national policies designed to protect and ensure the stability of the national economy of a country, areas of global inequality in terms of workers rights and how the protection of these rights has lead to areas like the Euro Zone finding themselves incapable of competing against developing markets where labour is cheap and operating costs are low, the idea of a unified, equal and protected Europe was appealing to all.

Industrialised nations were only too happy to climb into bed with their lesser developed neighbours as they saw opportunities to secure markets for their skills, manufacturing industries and productivity. As prosperity grew, the union, flush with the proceeds of member nations keen on building equality to stimulate trade, grow internal markets and develop the region, was only too happy to distribute huge financial incentives in the forms of this grant or that loan to facilitate infrastructure projects which in turn lead to the stimulation of job creation, and promoted an internal demand for manufactured goods, skills and supply lines throughout the Euro Zone.

All well and good while the system is working. Everyone seems to be equals, there is a collective system of bringing concerns to the table, discussing them, and working together to resolve any issues. Legislation is worked out, debated and determined to the benefit of all the member states, bringing into effect a national style of identity across the board in all EU Member Nations. Employees suddenly have equal rights from Romania through to France. Members from any member nations enjoy freedom of travel/movement. Protections are in place to protect savings, business, trade, infrastructure, natural resources, the environment and the collective economies of every member of the union.

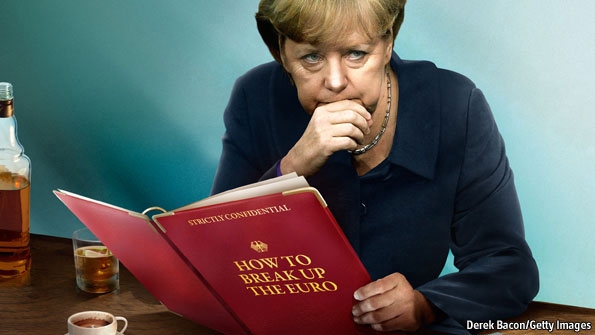

Courtesy – Derek Bacon – Getty Images

That is, until something goes wrong. Cue the global financial meltdown of the last five years. In these unprecedented financial times, it is clear to see the cracks in the system. Equality? What equality. For the first time in half a century, German dominance has once more taken centre stage as Angela Merkel shows time and time again over the last few years the reality of what equality means for Greek and now Cyprian citizens.

What truly beggars belief is the complete madness of fiscal policies that the Euro Zone seem willing to implement in nations on the edge of the system, places where it would seem to be of little consequence whether the idea is of sound and logical design, but drawn out more from a need to appease voters at home, than the equality or future reality for real, honest citizens of this United Europe. In a market desperate for stability, direction and a clear sense of responsibility, all we see are leaders rushing to dodge the bullet, pass the buck, and make sure at whatever cost that they are protecting their own national interests. Bugger the United Europe in this instance.

The worrying trend for me is the way in which at every turn along this torturous road it has been the German politicians that have really been calling the shots. Since the demise of the world money markets, we have seen any number of wealthy European Economies fall into fiscal woe. Ireland, Italy, Spain, Portugal to mention but a few. Yet in these cases billion dollar bail outs were handed out freely, without bringing a nation to its knees. Now however, when it comes to less important member states, economies perhaps not viewed as critical to the Euro stability, that we see the reality of what equality means to the German powerhouse. The sad thing is that when it comes down to it, no one within the Euro Zone has the financial muscle to stand up to Angela Merkel, and for this reason, she is able to bull headedly put the very future of Europe at risk to maintain credibility back home.

There is an argument that says Cyprus has become a safe haven for Russian Billionaires who use it as an off shore centre of storing large deposits of dirty money, and for this reason, why should German tax payers foot the bill to bail out the Cyprian government in their hour of need. I would love to see this argument used in Switzerland should heaven forbid, it ever need a financial bailout. Regardless of who has banked their money in a nations financial banking system, how does this translate to fairness when a fiscal demand attached to a bailout offer sees consideration given to taxation of ordinary savers who have placed their hard earned money into accounts throughout a nations banking system.

Stop for a single moment and consider what savings are. I have listened to numerous financial experts who freely wag their chins on Radio and National Television suggesting that savers should be exposed to the same type of risk as anyone investing their money in any type of investment based on the expectation of a payment of interest on their savings. For the vast majority of people, savings are exactly what they would suggest. Deposits made into what is perceived to be a safe and secure domain to prepare for a capital purchase at some time in the future. Why do we use bank? If it were safer to keep my money stored under my bed do you not think I would do this? The only reason we place our hard earned capital into a bank account is based on the idea that for the 95% of the population that are not wealthy, the bank is the only safe institution where we can store our money while we go through the motion of saving up for that deposit on a house, a new car, a family, education, business idea.

If we perceived a savings account as a financial risk, would we use it as a way of keeping our money safe? If we were told openly and honestly that in real terms, this is NOT a savings account, but a vehicle of investment, a loan in effect to the bank, and there was no guarantee that we would get out of it as much as we put in at the start, would honest, hard working, average people be at all interested in depositing any sum of money into a savings account?

Quite honestly, if this was the truth they were forced to print in the literature of a savings accounts terms and conditions, I could see the sales of home safes going through the roof in the next five years. If you are looking for a fairly good stock market investment right now, Chubb would be a pretty good bet!

All jokes aside, it is astounding to me, or any lay person, that anyone with access to the top financial economists money can buy, would even consider the proposal we currently see on the table in Cyprus. A tax on savings is ludicrous. Do you WANT to start a run on the banks? Are you seriously looking to destabilise the rest of Europe? I mean come on, can you honestly tell me that no one considered that a possible result of such a proposal would be that savers in every European Country in financial difficulties right now, would not look at the proposal in Cyprus, put two and two together, and realise that, just maybe, their own savings could now be at risk?

I am no economist. I do not work for any government, nor do I confer or speak daily to financial experts, and even I can figure out that this is a potential risk. Why? Simple. I am a saver, with funds in a large British Banking institution who is wondering if my savings could ever be pounced on if the UK gets into choppy waters. We’ve already been downgraded by one financial institution, indicating that they are expecting us to have difficulties in repaying our debt. What can I draw from this? At some point in the future, it is likely if not certain that the UK will default on its payments. When this might happen, who knows. It is even possible it will never happen, however, for someone out there, it is a very real possibility, and for that reason, it is a very real concern to me.

So what do I do? Rush down to the bank and draw out my savings? How many other people throughout Europe are asking themselves the exact same question right now? How do we now AVOID a run on the banks?

For many people, this is quite simply a fore runner of a tax on wealth. This means that for 5% of the worlds population, they are really itchy about having to pay more on their vast sums of money, so they would prefer to see 95% of the worlds population suffer to foot the bill so they can continue to live in the lap of luxury.

Fair? Where is the equality in that? No, I am sorry this is not balanced Europe. This is not a place where it does not matter what you bring to the table. When it comes down to the crunch, it is the people with the power, in this instance our good friends the Germans’ that are calling the shots. If it is not in their interest to offer a bail out plan, then to hell with it, they will bring the EU to its knees before they see any more of their taxes paid out to help their neighbours in the Euro Zone. So that concept of equality, openness fairness? Yes well, it works when it is in our interest to see it work, but when risk is put before us, and you expect us to come to the rescue, expect your lives to become a living hell while we do it.

As a simple worker, a person much like the majority of the sixty plus million people living in the UK, all I can see from where I stand is a super powerful Germany becoming a dictatorial leader within this Europe on our borders. When ludicrous fiscal policies are being put forward, debated, considered and insisted on by the weight of a financially powerful nation within a Union, I would suggest that the union is not quite a union. I cannot help but wonder if there are people behind the strings, hell bent on collapsing Europe. Plunging the world into an economic melt down like no other. Let us be quite clear. When the normal man is losing everything he owns, there are powerful institution’s, and hugely wealthy people making money as a result of the collapse. Is this what is really going on in the Euro Zone?

I cannot believe that the German’s do not know what they are doing. I am not able to believe that no one in a position of power has not been able to consider the very things that I have written about above, without considering the risks associated with these actions, and for this reason alone, I cannot help but wonder what the real reason behind it is. For a long time, people have talked about a single currency, a worldwide monetary system, the phasing out of dollars and cents, and the introduction of a financial monetary system for the digital age. Is this how they are going to do it? Force the collapse of one major economy? It is only logical that the collapse of one single national economy will start a chain reaction around the globe.

We are teetering on the edge of oblivion. In our life time, money, the way we buy and sell, our value system and how we trade will change. For this to happen certain things have to take place. Look for example at how the British people have resisted the Euro. The offer 20 years ago of a single currency, an inter dependence, a great new world was a bridge too far for simple people. The idea was shunned, and so back to the drawing board they went. So if you can’t get people to buy into an idea openly, how do you introduce the idea? You create a set of circumstances that demand that people have to adopt your idea to survive. Bring the world to the brink of a financial melt down, threaten peoples savings, lose people money in bank collapses, bankrupt a country or two along the way and what happens? You will cause a panic like never before. Introduce a solution, in a single currency, a digital trading system that does away with paper money and plastic credit cards, and means that you store your financial certainty in your body in the form of a chip or some such device, safe, secure and never again at threat from being lost in some scary international collapse, and every single person will buy into your idea without batting an eye lid.

How certain are you now that Germany are not behind some weird kind of world domination conspiracy? Didn’t the Third Reich want to own the world?

I am not one for a conspiracy theory if I am honest. There are too many ifs, buts, ands, etc. Questions without answers, and assumptions without evidence. I don’t like assumption. However what I am saying is that there is something more than meets the eye going on here, and if it looks like a dog, sounds like a dog and feels like a dog, then sorry it is a dog!

I don’t know exactly what is going on, but one thing I am certain about. We will see a very different world soon. It is going to happen in our life time, and not for the first time in my life, I am certain that these are the end of days as we know them. Something very different is coming and it is coming soon.